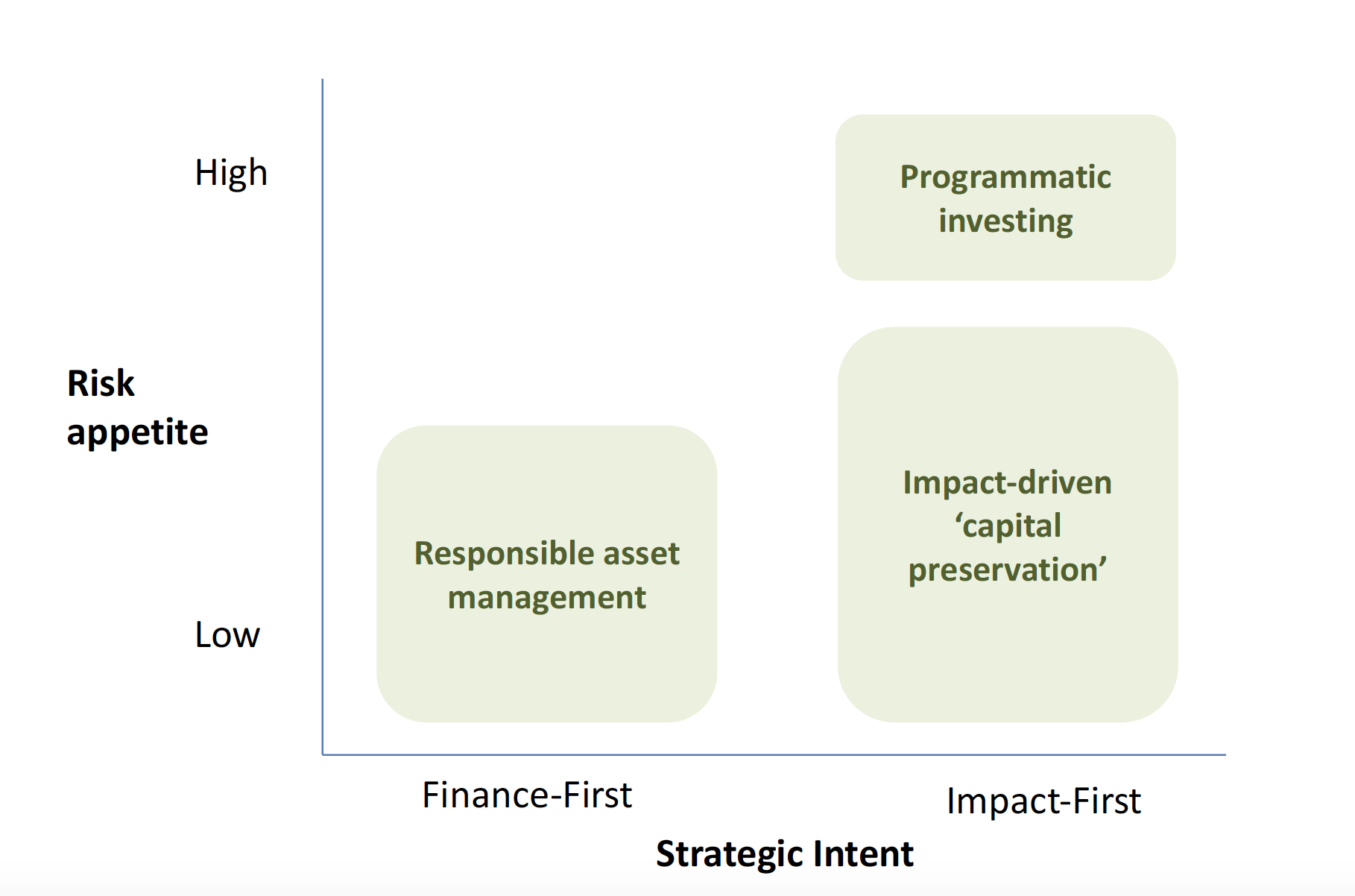

We have historically had three broad investment approaches, each optimized for a different point on the risk/return/impact spectrum. This is based on an assumption that in most cases, given our focus on low-income communities, more impact is generated by increasing risk appetite or reducing return expectations.

Our responsible asset management strategy is our most conventional approach. This strategy seeks broad values-alignment with our core mission, but has significant leeway in this interpretation. Our goal with funds allocated in this manner is to achieve returns comparable with traditional investment portfolios. We plan to divest from this strategy in the long-run as we expand our more impact-first and programmatic initiatives.

Our largest allocation of future funds will be dedicated to our impact-led, capital preservation strategy. This pool of capital seeks to have direct and measurable impacts on our target communities while still underwriting to a risk standard of returning capital from all investments.

Finally, we maintain a pool of programmatic funds, deployed primarily in the form of PRIs (program-related investments) where the risk of capital impairment is particularly high. This pool funds interventions such as early-stage pilots or entry into new, high-risk markets.