Coffee Stimulates Energy and Impact

07 Aug, 2024

To keep our energy levels high, our team at Ceniarth contributes meaningfully to the 400 billion cups of coffee that are consumed annually worldwide. However, as we enjoy our daily beverages, we are all acutely aware of the critical importance of coffee to smallholders globally. Over 25 million smallholders are engaged in coffee cultivation accounting for more than 75% of all coffee produced. From Brazil, Vietnam, and Indonesia, to Uganda, Kenya, and the Central African Republic, coffee farming is an essential livelihood in much of the Global South. In countries such as Nicaragua and Honduras, coffee can account for more than 25% of all agricultural GDP.

Yet, as with most goods that can command premium export prices, only a small fraction of the ultimate cost to the consumer flows back to the farmer. In some cases, one might be paying $4 for a coffee at their local café with only $.04, or 1%, going back to a farmer. Beginning with the development of Fairtrade certification in the 1990’s, there have been a variety of efforts to ensure greater economic benefits for producers. From helping cooperatives and producer organizations invest in processing capabilities to creating more direct sales channels between farmers and foreign roasters, there are range of interventions shaking up the coffee value chain.

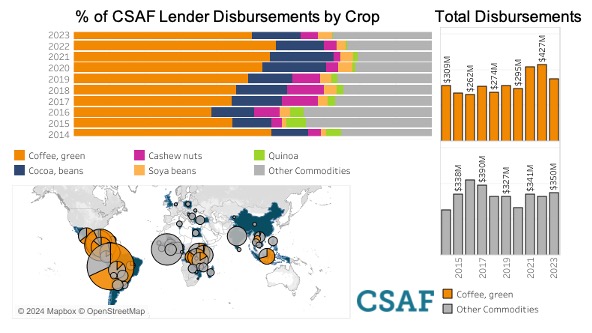

Impact investors have played a key role in the sector’s transformation. The most recently published data from the Council on Smallholder Agricultural Finance (CSAF), the trade association for agricultural impact lenders, reveals that coffee continued to account for half of all investor disbursements in 2023. While this is down, due to price volatility, from 57% of disbursements in the prior year, it is clearly a value chain that is front and center for those of us in search of ways to increase farmer incomes.

CSAF Lender Data By Crop

In pursuit of efficiencies in the sector, lenders and intermediaries are trying to listen more closely to farmer priorities. 60 Decibels recently published a survey of smallholders working with Sucafina Uganda, a coffee buyer and processor servicing over 8,000 farmers in the country. The survey focused specifically on the pros and cons of digitization of payments to coffee farmers. Similarly, our impact and research team at Ceniarth has been spending more focused time understanding the concerns of smallholders in this value chain.

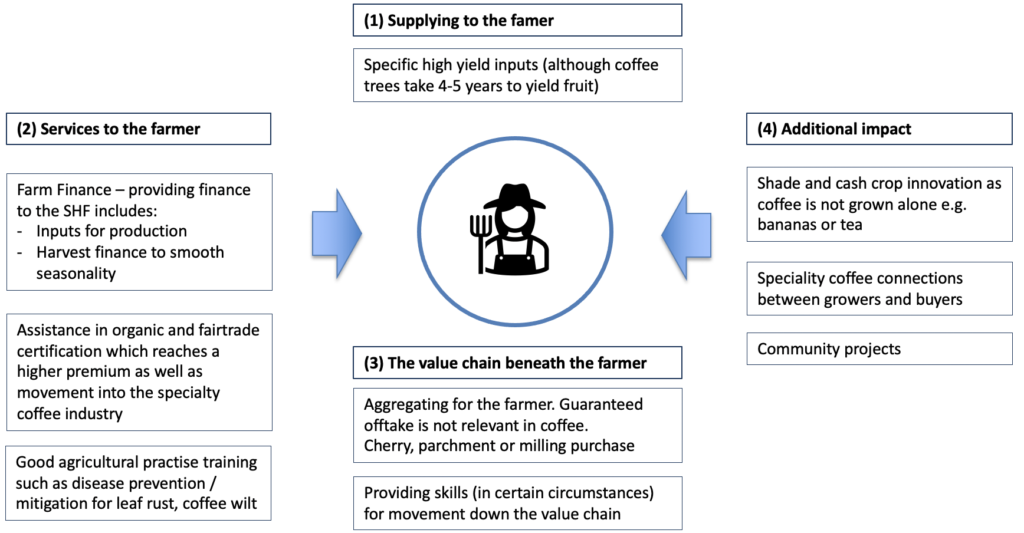

Driving Impact at the Smallholder Coffee Farmer Level

Historically, we have only invested in this market indirectly via intermediaries. We have been a longtime investor in Root Capital, a leading lender to coffee cooperatives globally. Root has worked hard to complement its financing with technical assistance, education, and industry advocacy. In addition, a number of our other impact fund managers such as Clarmondial, ResponsAbility, MCE Social Capital, and Global Partnerships are active in the coffee value chain.

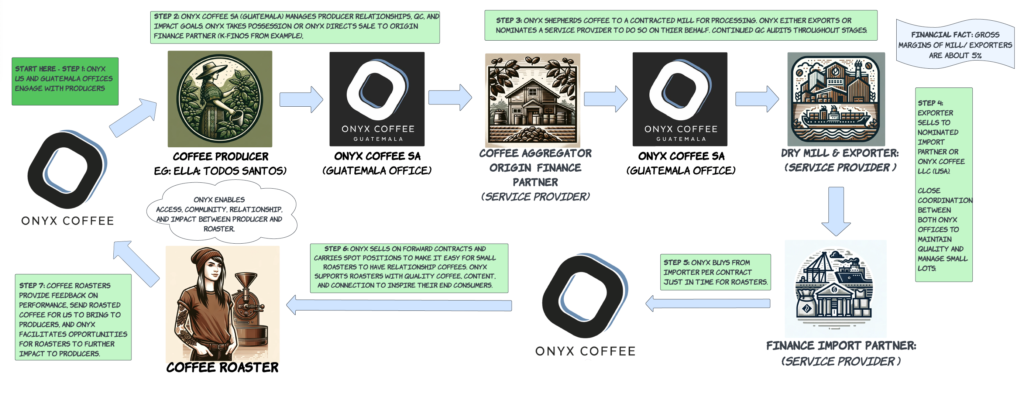

Beyond this focus on cooperative lending via intermediaries, we have begun to lend more directly into the market, particularly to social enterprises in the specialty coffee market that can help turn premium prices paid by foreign consumers into additional profits for coffee farmers. Last month, we closed a new working capital credit line with Onyx Coffee.

Onyx was founded by Edwin Martinez, a third generation coffee producer in Guatemala who recognized the opportunity to connect high quality coffee farmers more directly with US consumers. Onyx now has extensive relationships throughout the value chain working with over 150 farming groups and 300 roasters. Onyx is able to showcase the quality of these Guatemalan beans to specialty roasters and can help capture additional economic value for cooperatives and farmers.

Onyx Value Chain Additionality

Earlier in the year, we also closed a working capital line with Thanksgiving Coffee, a true pioneer in the sustainable coffee sector founded by Paul and Joan Katzeff in the early 1970s. Working under the motto “Not Just A Cup, But A Just Cup”, Thanksgiving has been working out of its base in Northern California to import high quality, ethically, and sustainably produced coffee for over five decades. A family-owned B Corp, Thanksgiving sources a significant amount of its product from Nicaragua, where Paul’s initial inspiration for the business was launched, as well as elsewhere in Latin America and Africa.

Most impact interest in enterprises such as Onyx and Thanksgiving Coffee has come from funders like Ceniarth that primarily have a livelihood lens on improving economic conditions for vulnerable, rural communities. That said, coffee is more than just a community issue, it is also an issue of climate resilience. Global coffee prices are currently surging as drought conditions brought about by climate change in Vietnam and Brazil has led to severely restricted supply of both high quality arabica, as well as lower quality robusta typically found in instant brews. In addition, new deforestation regulations enacted by the EU and set to take force in December of 2024 have positive climate intentions, but will stretch the compliance abilities of smallholders.

In particular, there has been increased activity from investors in supporting the planting of new climate resilient, as well as disease and pest resistant coffee tree varieties, a process otherwise known as renovation, Given a 3-5 year time frame for these trees to reach productive maturity, there is a clear gap financing need to make this viable for smallholders dependent on regular, annual harvest income. Funders with an emphasis on climate might recognize these significant opportunities in the coffee sector.

Coffee, much like cocoa and other crops with premium value in export markets, represents an important opportunity to deliver fair economics for farmers and to ensure that the insatiable demands of consumers leads to profits for growers. We are going to stay closely focused on the coffee sector at Ceniarth, not only because it gives us our daily fix, but because we are acutely aware of its impact importance to smallholders globally.